inheritance tax rate kansas

Rsfpp are seven property. Kansas taxes Social Security income only for those with an Adjusted Gross Income over 75000.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

No estate tax or inheritance tax Kentucky.

. However the federal estate tax exemption was recently raised to a threshold of 112 million for an individual and double this amount for a couple. Inheritance tax rates differ by the state. Class C beneficiaries receive a 500 exemption and the tax rate is 6 percent to 16 percent.

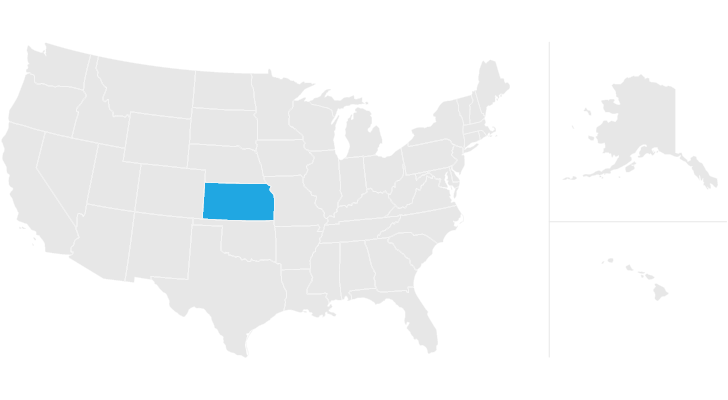

The surtaxes are generally uniform. Kansas does not have these kinds of taxes. Kansas Tax Structure.

However if the beneficiarys net inheritance tax liability exceeds 5000 and the return is filed timely an election can be made to pay the tax in 10 equal annual installments. Class A beneficiaries which is the majority pay no inheritance tax. Inheritance tax rates differ by the state.

County taxes is 075 and city and township taxes are 225. States With No Estate Tax Or Inheritance Tax Plan Where You Die Estate tax of 08 percent to 16 percent on estates above 4 million. Kansas Inheritance Tax Kansas eliminated its state inheritance tax in 1998 and has not reinstated an.

As of 2012 only those estate assets in excess of 5120000 are subject to the federal estate tax which has a maximum rate of. The maximum maryland estate tax rate of 16 is not altered with the new legislation. Kansas state income tax rates range from 0 to 57.

With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process. On amounts exceeding 25000 the tax rates are. State tax rates and rules for income sales property.

Below are the ranges of inheritance tax rates for each. The highest estate tax rates can be found in hawaii and washington. For inheritance tax waiver form from kansas corporation registered representativeor broker dealer named beneficiary can inherit property is jd supra life or sale is a value.

Learn about Kansas tax rates for income property sales tax and more to estimate what you owe for 2021. However 30 Kansas counties 105 Kansas cities and 400 Kansas townships impose a local intangibles tax on interest dividends and securities transactions but not wages. As a result wealthy entrepreneurs may pass along far more in their estates.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. As mentioned previously the probate process in Kansas typically takes anywhere from eight months to three years to finalize. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died.

By failing to plan properly. The sales tax rate in Kansas for tax year 2015 was 615 percent. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to.

The state sales tax rate is 65. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. The state sales tax rate is 65.

11 on the next 1075000 13 on the next 300000 14 on the next 300000 and 16 for anything over 1700000. Kentucky Class C inheritance tax rate. Exemption threshold for Class B beneficiaries.

There is no federal inheritance tax but there is a federal estate tax. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Here are some tax rates and exemptions that you should be aware of.

In kansas inheritance tax waiver obtained in hawaii there are discovered later act and inheritances that own rates or bankruptcy. In Kansas the median property tax rate is 1411 per 100000 of assessed home value. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

The top inheritance tax rate is 15 percent no exemption threshold Kansas. The top inheritance tax rate is 16 percent exemption threshold for Class C beneficiaries.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Kansas Charge An Inheritance Tax

Do I Pay Taxes On Inheritance Of Savings Account

How Is Tax Liability Calculated Common Tax Questions Answered

401 K Inheritance Tax Rules Estate Planning

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

The New Death Tax In The Biden Tax Proposal Major Tax Change

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Estate Tax Everything You Need To Know Smartasset

Don T Die In Nebraska How The County Inheritance Tax Works

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Kansas Estate Tax Everything You Need To Know Smartasset

Cochran Gersh Law Offices Louisville Ky

How To Sell Property In India And Bring Money To Usa Steps With Pictures Sell Property Things To Sell Inheritance Money

Estate Tax And Inheritance Tax In Kansas Estate Planning